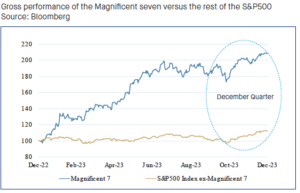

What the ‘everything rally’ did to markets in 2023

The investment market in 2023 was strong – unlike the year prior – largely thanks to an impactful December quarter. It’s a great example of the need for patience and a reminder of the importance of a long-term view when investing. The positive returns were driven by what we’re calling the “everything rally” – a perfect storm of equities rallying...