This article was written in early May.

In the last issue of the Profit, I used the term “market correction”, and boy oh boy, did we have one of those! Not for a second am I claiming a prediction of Covid-19 and the effect on the markets, but I will state that now more than ever real relationships with our clients are paramount. Also, it’s important to do your homework on your investments before black swan events take place; we’ve now had two in the last 15 years.

But before we talk about that, let me say that I really feel for the businesses of Hawke’s Bay, many owned and operated by people whom I know personally, and the impact that Covid-19 is having. New Zealand and to an extent Hawke’s Bay, as primary producing economies, will feel the effects of Covid-19 for some time to come. Stimulus packages have tried to target employment retention and cash flow concerns but the real economy, effectively the flow of non-monetary factors, will struggle to get back to full pace in a short time. I feel the real effects of Covid-19 are yet to be realised.

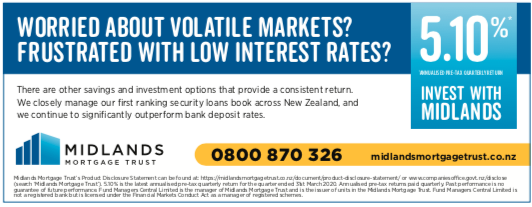

Thankfully, at Midlands our relatively vanilla offering to our conservative investors means that we have not experienced the volatility of other sectors – our strength is based on the quality of our lending book and the liquidity and management practices we have in place. Sure, we’ve had to work with some borrowers regarding their debt serving abilities, but so far this has been done without any material adverse effect on the performance of the fund. Being diversified around the country and having low Lending to Value Ratios (LVRs) has helped that profile.

Investors trust Midlands to give them a consistent and conservative return, over and above main bank rates. They do not invest with Midlands with the intention of significant volatility. But volatility is what investors got in many other sectors, including multi-sector solutions such as KiwiSaver.

I have written at length in the past about factors such as liquidity, volatility and getting an asset allocation that meets your needs and goals when looking to invest. There is considerable material available in investment documents, such as Product Disclosure Statements (PDS), that assist in making these decisions. Your total asset allocation (all your investments) should be based on your needs, not just in fair weather, but over time and reviewed accordingly. Past returns should be balanced with defensive factors, diversification of assets, when and if income is distributed etc.

So, I read with bemusement (and great worry) that many KiwiSaver investors switched to conservative or income funds when Covid-19 had violent effects on the market, mainly in late March and early April. There is enough literature to say that financial professionals cannot time markets effectively, let alone the layman. So why do it? If you do not trust the manager of your funds to navigate what they can within their investment mandates, I would suggest you have chosen the wrong manager. Already we have seen markets correct back considerably meaning that those who switched have crystallised losses and have missed the considerable “bounce”.

I fear that Gen X and Gen Y will bear the main burden of the fiscal stimulus packages of Covid-19 for years to come, via taxation, estate duties (from the boomer generation), means testing of superannuation and many other vehicles yet to materialise. They should not be burning their long term nest eggs with poor investment and asset allocation decisions as well.

There are many factors that determine what you should invest in, especially in KiwiSaver as a “long” investment. But time is one of the most vital considerations. If you do not have the stomach for volatility, nor the time, then a more balanced or conservative type fund is more appropriate from the outset, not after the fact.