The COVID-19 pandemic is a significant event.

So ….. where to from here? If I had a dollar for each time I was asked what affect this will have on future property values I could probably retire. Possibly, the more important question should be: What is the impact going to be on volume? Answering this question will probably give a more informed prognosis because in time it will have a more material impact on property values.

‘Alert Level 4’ saw the sudden shutdown of all non-essential business and it is well recognised that operating in this environment has had a major impact on the national and local economy. Much of the modelling regarding the economic impacts and subsequent recovery are based on data from the Global Financial Crisis (GFC). However, even the GFC did not, all but suspend sales transactions so it’s safe to say the property market has had a very big shock. How market uncertainty is managed both in the property sector and more generally in the wider economy will play a big role in recovery.

The lowering of alert levels has allowed real estate agents to operate and we are starting to see an increase in property transactions as the market reactivates. Transactions post ‘Alert level 4’ to date indicate a levelling in values. However, there is still a way to go and the full impacts to the economy may only become evident in the next 6-12 months. The Government, Reserve Bank and Retail Banks have implemented a multitude of assistance packages to soften the blow and help stimulate economic activity. This may help hold immediate value levels, however; all indicators are that we can expect the impacts to be negative as the furlough packages are removed.

Most of the sales data that has transacted through ‘Alert Level 4 and 3’ was negotiated prior to going into ‘Level 4’ lockdown. Consequently, the property market post COVID-19 is in unchartered territory and property market dynamics as we have known them have been rendered obsolete. At the time of writing this article there was not yet a full month’s worth of data of sales transactions. Therefore, we are not able to fully analyse the impact of COVID-19 on property values. The REINZ data for April shows a substantial reduction of 83% in volume of transactions and the record median sale price was clearly influenced by a small volume and weighting of transactions in the higher price bracket. This is not surprising due to the sales transactions being stalled and most regions (bar one) recording their lowest volume of sales transactions since records began.

Currently property agents have reported there being good activity with strong buyer demand, and multiple offers still being presented to vendors. While we are not privy to consideration levels, transactions that have been reported are at comparable value levels to those that would have been expected prior to 25 March. However, business survival and subsequent job losses will have a significant impact on market sentiment, and it is highly likely that any falls in value may not transpire for some time yet.

To assist in quantifying what impact the COVID-19 crisis might have on residential property values we have looked at the impact the Global Financial Crisis (GFC) had on the residential property market.

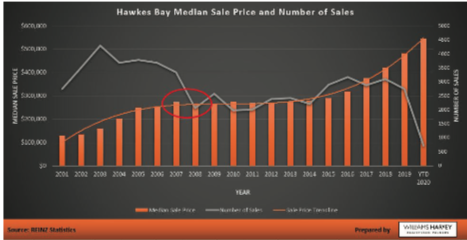

Internationally the fallout from the GFC was seen in 2007 but locally we did not see the impact on our market until 2008 showing a reduction of 2.36% in our median sale price (MSP) from the 2007 year. Of more significance, was the impact to the volume of transactions, which dropped from around circa 3,700 sales per annum prior to the GFC to circa 2,100 per annum post GFC, a reduction of some 43%.

Economists and expert commentators are suggesting the full economic impact of COVID-19 will be worse than the GFC with unemployment rising to somewhere between 8% to 11%. This is when we will see a material impact on residential property values with most predicting a drop of somewhere between 5% to 15%.

Where there is likely to be an immediate impact is in the volume of sales transactions and days to sell. Ultimately, we have a more positive outlook for our local market than the economists and estimate up to a 5% reduction in value and up to a 40% reduction in volume. Some predict a bigger reduction in volume; however, we are starting from a lower volume of transactions pre GFC.

Indeed, interesting times ahead.