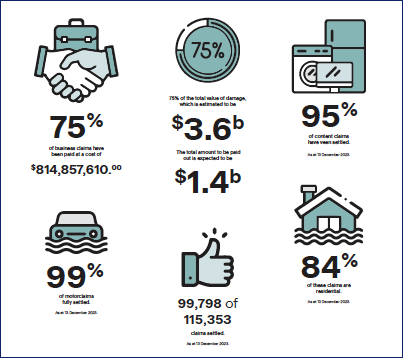

It is hard to believe that a year has already passed since Cyclone Gabrielle devastated our region. What has happened a year on regarding insurance claims, and how will it affect your premiums moving forward? As at 13 December 2023, insurers had settled 99,798 of 115,353 claims (about 87%) from the Cyclone Gabrielle and Auckland Anniversary events, according to the latest Insurance Council of New Zealand report.

75% of business claims have been paid at a cost of $814,857,610. This was said to be tracking as expected with business interruption claims being spread over time. The total amount to be paid out is expected to be $1.4 billion. All of these claims account for about 75% of the total value of damage, which is estimated to be $3.6b. This total however does not include the uninsured losses to the economy.

Impact on insurance premiums

It is no surprise with the cost of these payments that it will have a massive impact on insurance premiums, not just for Hawke’s Bay but for the entire country. Reinsurance premiums, paid by our local insurers to protect themselves from catastrophic events, have been increasing for several years. The cost of reinsurance, to cover catastrophic events, is one of the largest expenses for an insurance company. More unpredictable weather events mean a rise in reinsurance costs, which then of course get passed on by insurers to the consumer. Premiums for most policy types are therefore expected to increase over the next year.

In addition to reinsurance costs, another reason for the premium increases is the inflationary environment. This is caused by the increasing cost of materials to repair or replace property and cars. Legal fees and settlements paid for liability claims and any other fees that need to be paid to assess an insurance claim are also increasing.

Availability of insurance

It is not just the cost of premiums that will be a challenge for many this year. It is also around the availability or capacity of the insurance available. Insurers may reduce the amount of cover they are willing to provide in certain areas due to the increased risk. As insurers update flood models with the change in weather patterns for example, we are already starting to see them decline cover in some areas.

Brokers shown to have greater insurance outcomes

A recent survey by Vero showed that clients who used an insurance broker were more likely to have improved outcomes along with having greater confidence in their level of cover. Rising premiums and reduced insurance capacity are not new to any seasoned insurance broker, so if you haven’t engaged a broker to manage your personal or business insurances perhaps now is the time to think about it. A good broker will focus on positive alternatives and potential solutions to address the challenges the current market is providing, including how we can further mitigate any of your current risks. Our team is also of course willing to talk to anyone who is not happy with the outcomes provided by their current broker and to help ensure that you feel secure in your risk and insurance programme.

You can do this Hawke’s Bay

We have come a long way in the last 12 months to recover and rebuild. Whilst there is still much to do, we have come through a large array of natural disasters before over the last 150 years. The people of our region are resilient, and we will bloom back into full life again in time.

We can do this! icib.co.nz