In November last year the NZ residential property market was running hot, as it was locally, evidenced from ever increasing values, the peak of which appeared to be in the latter part of last year. One could only wonder how long the upward trend could be sustained especially as there had been no letup in buyer fervour since the end of the first lock-down in 2020. To be frank some of the value levels achieved were simply eye watering.

Market conditions have a direct bearing on the property’s market value and Williams’ Harvey (WH) accumulates a library of research from numerous commentaries and views of economic/research analysts to build a ‘big picture’ oversight.

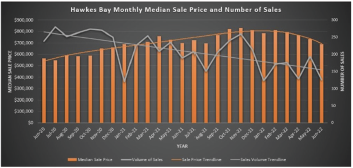

Looking at our most recent data sets, the year to date (YTD) Hawke’s Bay volume of sales is down 34.7% from previous month and 33.3% from previous year. It is also well reported that there is plenty supply of houses for sale and yet the volume of sales in Hawke’s Bay is the lowest for the first six months of a year recorded for over 20 years. Furthermore, the amount of time a property is on the market has also increased to 66 days, the highest recorded time since January 2009.

So, with volume down, time on the market to sell increasing and plenty of stock tilting the market towards the buyer, it is not surprising that we are starting to see some downward pressure on house values. Consequently, vendor’s are starting to realise that they have got to accept adjusted values. At the time of writing this article ANZ had also revised its forecast for how far house values would fall, increasing the predicted drop from 12% to 15% from previously.

This adjustment was attributed to the prediction that economists are now flagging inflation to peak at higher rates than first predicted and become less transitory and more persistent in duration. In response the RBNZ has raised the OCR 150 basis points (bp) since February 2022. The most recent MPS announcement (13 July) saw this go up 150 bps to give an OCR of 2.5%. Whilst raising the OCR was predicted, what has been widely unexpected was just how aggressive the MPS forecast track for the OCR would be with another 50bp increase also predicted in August. So whilst NZ joins most other countries as it transits out of its pandemic response phase, the post pandemic ‘new normal’ is still going to be economically tricky for the foreseeable future. The net result being downward pressure on house values.

Since the beginning of the year, we have been put on notice that there were significant head winds that would cool the property market, and these appear to be coming into play However, given the exponential growth experienced by the property market in the last 24 months this also needs to be seen with some perspective. For example, in February 2020, the month before the impacts of the Covid-19 pandemic hit the property market the Hawke’s Bay Median Sale Price (MSP) was $516,000.

The market exploded and peaked in November 2021 when the Hawke’s Bay MSP hit $830,000. The latest MSP data we have for June 2022 is recording a decrease of nearly 17% since November 2021, however, there has been an overall 33% increase in the Hawke’s Bay MSP since the beginning of the pandemic.

NZ continues to operate in a pandemic response environment as the highly contagious Omicron variant runs its course through the population. As signalled, this has and will continue to impact productivity as human resourcing disruptions, a tight labour market and supply constraint issues become part of day to day business management. Also, as signalled, inflation both at home and overseas is the predominant economic nemesis.

These inflationary pressures are further exacerbated by wider economic fallout from the current geopolitical crisis stemming from events in the Ukraine and the flow on effects from rising fuel costs and economic sanctions that will have a direct impact on global financial markets and supply chains.

Subsequently, we are currently seeing a slow down with good supply yet low volume of sales, longer periods to sell and the subsequent easing of values. This is a comparable trend being seen throughout many NZ regions, though it’s important to put this in perspective and remember that before the pandemic MSPs were approximately 33% lower, so even if the market does experience a 15% value decrease, values still remain higher than they did two years ago.