Commercial and industrial property investors see positive investment conditions over the next 12 months in Napier and Hastings, according to the latest Colliers International commercial property investor confidence survey.

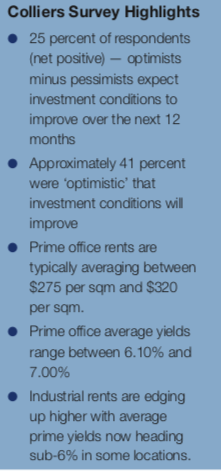

A net positive (optimists minus pessimists) 25 percent of respondents expect investment conditions to improve over the next 12 months, which was up slightly from the previous 2Q 2019 survey.

The survey also revealed quite a significant shift up in the number of optimistic respondents.

Approximately 41 percent were optimistic in the 3Q 2019 survey, versus 30 percent in the Q2 2019 results. More respondents shifted out of the neutral category, one of the largest shifts recorded in the Colliers survey.

There are a few key features in the Hawke’s Bay sector that is driving the positive sentiment.

Interest rates at all-time lows, with an expectation of rates to fall further, is driving some of the sentiment.

Access to capital remains a key element to this, and discussions around higher margins from potential changes made by RBNZ on capital requirements for banks (announcement expected in November) will most likely benefit experienced investors who can show a positive track record. Banks remain competitive for quality opportunities.

Another driver of the sector in Hawke’s Bay market is the demand and supply balance. Opportunities to lease space have been reducing recently. Also, general market

conditions have meant owners have been able to benefit from rising rents.

In the office sector, we have seen rents climb steadily over the past year, especially for the highest quality properties. Prime rents typically average between $275 per sqm and $320 per sqm. Prime average yields range between 6.10% and 7.00%.

In the retail sector, prime retail rents have been broadly flat over the past year, but prime average yields continue to sharpen, now ranging between 5.60% and 6.50%, down around 60 basis points in 12 months.

Industrial market conditions carry a lot of favour with investors with rents edging up higher as well. Average prime yields in the industrial sector are heading sub-6% in some locations.