Let’s hope that this year does not mirror the tumultuous start of 2023, marked by cyclones and market uncertainty as market conditions have a direct bearing on the property’s market value. Economic predictions and their outcomes, and impacts, specifically on the property market, remain an exercise in crystal ball gazing.

However, Williams’ Harvey accumulates a library of research from numerous commentaries and views of economic/research analysts to corral the trends and build a ‘big picture’ oversight and it seems timely at the beginning of the year to have a look at the local Hawke’s Bay picture.

There is consistent evidence to suggest the local property market (like much of New Zealand) is in transition as the volume of residential property sales has decreased, house value increases have shown a deceleration, the median days to sell have increased and levels of inventory have increased. The February 2024 REINZ report for Hawke’s Bay shows the January 2024 figures show that the MSP for Hawke’s Bay increased by 3% to $677,000 compared to January 2023, but back slightly to the December 2023 MSP. For New Zealand (excluding Auckland) the MSP has dropped marginally year on year (-0.7%) to $760,000 month-on-month compared to the same time in 2023.

There are some predominant factors contributing to the current environment. Firstly, the cost of living has irrefutably increased with rising inflation. Secondly, the aggressive measures taken by RBNZ to curb this inflation with the steep OCR hikes which increase mortgage security lending interest rates.

Thirdly, a lack of access to finance due to the amendments to the Credit Contracts and Consumer Finance Act (CCCFA) which came into effect in December 2021. These amendments have seen lenders apply draconian assessment parameters to buyers applying for mortgage security funding. The total number of properties sold across New Zealand in January 2024 increased 4.9% year-on-year to 2,995 and decreased 44.1% month-on-month from 5,357.

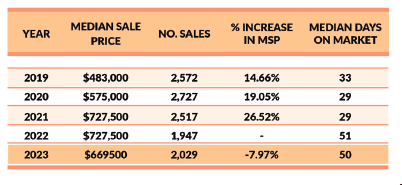

The current median Days to Sell of 45 days is more than the 10-year average for January which is 42 days. There were 16 weeks of inventory in January 2024 which is 8 weeks less than the same time last year. The pressure for value growth continued through to 2021, levelling out in 2022 and reducing in 2023. The Hawkes Bay volume of sales recorded for 2022 was the lowest annual volume Hawkes Bay has recorded in over 30 years. This low volume of sales continued for 2023 which recorded a slight increase in the volume with 2,029 sales, however, is well back on the higher volumes recorded 2015 to 2021 where volumes of sales ranged between 2,517 and 3,110 per annum.

However, to put it into perspective there has still been significant value growth in a relatively short time frame. Analysis of the last five years of activity shows that the MSP table (the median of the monthly MSP recorded by REINZ) shows an increase of 38.16% on pre-pandemic values.

Annual medians (as expressed in the table) can be misleading, therefore, we have also analysed the REINZ statistics into Quarterly blocks and compared to the MSP of each previous quarter. The heat of the market peaked in Q4 2021, however, each successive quarter in 2022 produced a negative result with a declining MSP which continued into Q1 of 2023, after which the market stabilised and firmed in Q4 2023.

The quarterly volume of sales increased each quarter from Q1 2023 at 401 sales through to Q4 2023 at 574 sales. This indicates market conditions became more positive as the year progressed. New Zealand is now well the other side of the pandemic.

Inflation at home and overseas is still the predominant economic nemesis. Some pundits predict the tide may finally be turning, albeit slowly, whilst others forecast more hikes due to strong employment data. So, there is still some way to go before the ‘war on inflation’ is won as this is still well outside the RBNZ’s target band. There are a couple of new variables that look set to play a key role in dominating the economic outlook for 2024, being the impacts of migration, and fiscal policy. Once again 2024 is shaping up to be another tricky year to negotiate.